Demand pattern in residential real estate changed in 2017: Sunil Agarwal, RICS

BY: Sunil Agarwal, FRICS, Associate Dean and Director, School of Real Estate, RICS School of Built Environment, Amity University

It has been an action packed year for the real estate sector. The year 2017, saw the implementation of two historic legislations, the Real Estate (Regulation and Development) Act, 2016 and Goods and Services Tax (GST), which will alter the course of the sector. This came at a time, when the sector was still reeling under the shock of demonetisation-a policy measure announced by the government in 2016 to flush out black money from the economy. Demonetisation squeezed liquidity out of developers, forcing them to change their business models. For instance, developers now prefer to enter into joint development agreement with land owners over outright purchase of land. The year also saw India's apex court come to the rescue of distraught home buyers in multiple cases filed against developers. RERA is expected to take care of all future buyer grievances.

In the office space, strong economic growth continued to generate demand. The last two years 2015 and 2016 have been quite good for this segment with pan India office vacancy at its lowest in 5 years. Vacancy levels in some cities such as Bengaluru, Chennai, Hyderabad and Pune is around 5-10%, while pan India vacancy is at around 14-15%. On the supply side, there is a shortage of grade A office space. It is less than half of the current office stock across top eight cities at 280 million sq. ft. The gap between demand and supply of good quality office space is keeping office rentals strong. In comparison, retail properties saw significantly less rental value appreciation, especially in the National Capital Region. Mumbai and Bengaluru fared better. While occupier demand continues to rise in the office sector, there was no change in demand in the retail segment.

It was not the best of years for the residential property market. Businesses had to be realigned to comply with the stringent rules of RERA and GST. New project launches have slowed down and home prices seem to be under pressure. RERA has increased both the compliance level and cost for developers. Demand for luxury homes has taken a hit, while affordable homes continue to attract buyers.

GST, the other landmark legislation, has changed the demand pattern in the residential market. The tax does not apply to completed or ready to move in apartments. It only applies to under construction properties, which will be charged at 12 per cent (this does not include stamp duty and registration charges). This has caused a shift in buyer preference to ready to move in homes to avoid payment of GST. It is difficult to quantify the exact impact of GST on property prices. While developers will be able to avail input credit on goods and services bought and used during the construction process, we will have to see if they will pass this benefit to home buyers. GST is nevertheless expected to benefit affordable housing. The new tax regime is expected to keep real estate costs low for the affordable housing segment, thereby making it cheaper.

The positive impact of demonetisation from a home buyer's point of view is a fall in home prices. Land prices are however expected to remain the same. The other positive effect of this reform measure is an increase in regulation and tax compliance, though how much of this would translate into an increase in tax collection will have to be seen.

By: Ravi Kumar Diwaker (Magicbricks Bureau)

By: Ravi Kumar Diwaker (Magicbricks Bureau) NEW DELHI: The Narendra Modi government has pumped in three and half times more investments than the previous UPA government to improve basic urban

NEW DELHI: The Narendra Modi government has pumped in three and half times more investments than the previous UPA government to improve basic urban  By: Shaveta Dua, Magicbricks Bureau

By: Shaveta Dua, Magicbricks Bureau

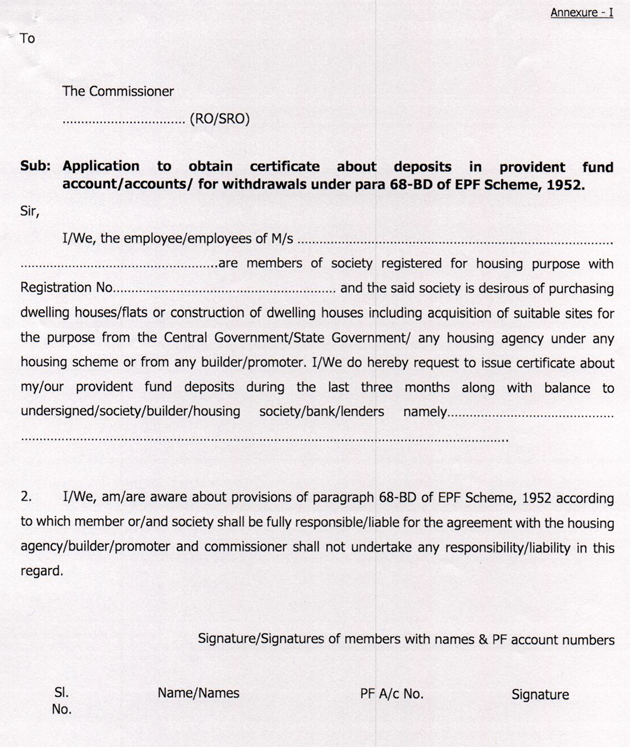

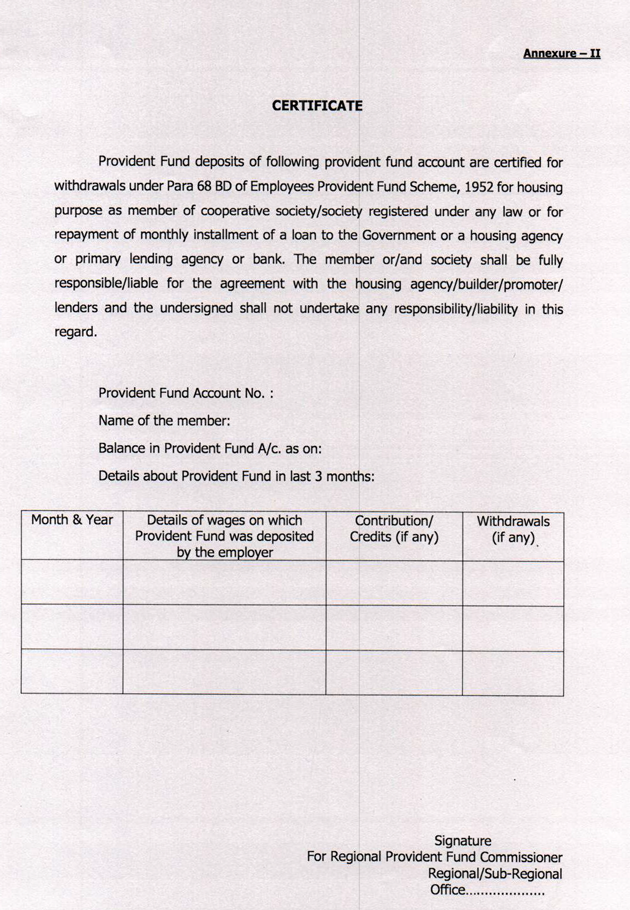

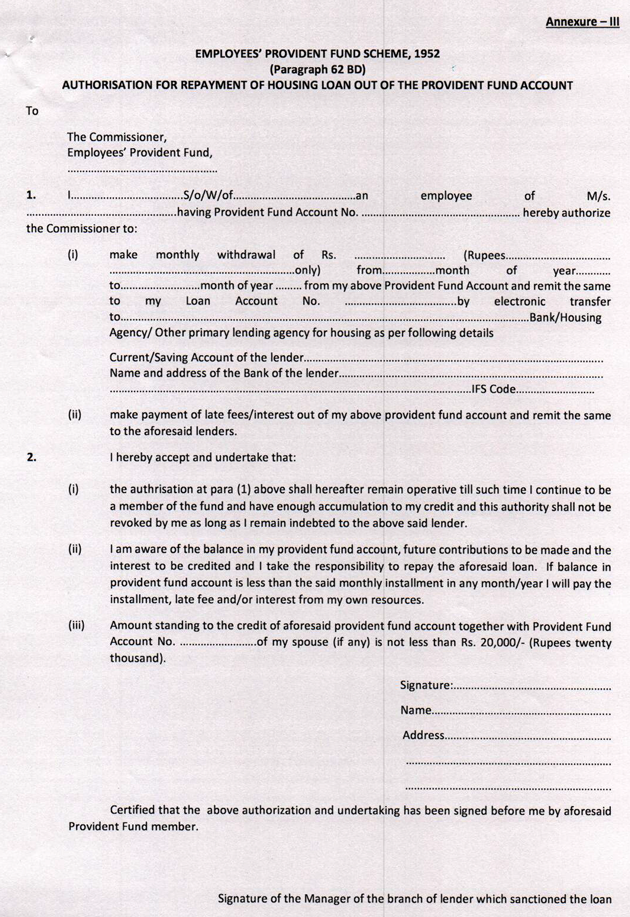

The government it seems is pulling out all the stops in making 'Housing for All by 2022' a success. The initiative gets a shot in the arm by allowing members of

The government it seems is pulling out all the stops in making 'Housing for All by 2022' a success. The initiative gets a shot in the arm by allowing members of

By:

By: