EPFO: Here is the step-by-step process to withdraw 90% of your PF to buy home, Real Estate News, ET RealEstate

The government it seems is pulling out all the stops in making 'Housing for All by 2022' a success. The initiative gets a shot in the arm by allowing members of

EPFO i.e. the contributory employees, to dip into their retirement savings to own a home of their own.

EPFO has allowed members i.e. the contributory employees of the

provident fund (PF) scheme to use 90 percent of EPF accumulations to make down payments to buy houses and use their accounts for paying EMIs of

home loans.

Under the new rules, an essential requirement for a PF member to withdraw one's PF money to buy a

real estate property is that he or she has to be a member of a registered

housing society having at least 10 members. An employee who has been allotted a PF number is considered a PF member by the EPFO.

The new rules will be in addition to the existing rules for withdrawal of PF by the employees to fund their home buying. Neeti Sharma, Sr. Vice President, TeamLease Services informs, "This is an additional condition under which the PF member can avail loan apart from the conditions prevailed earlier. He can withdraw funds in his individual capacity if he does not want to be a member of a housing society, provided all the requisite documents are in place. Since the previous rules prevail, he can still withdraw funds for purchasing a house."

As a member, one can use the PF funds for an outright purchase, as a down payment for a home loan, for buying plots, for the construction of a house. The transactions can be made through central government, state government and even from a private builder, promoters or developers. Only those members who have completed 3 years as a PF member will be eligible for this scheme.

No secondary market dealsThe rules, however, do not encourage secondary market or resale transactions of real estate properties. EPFO will be making the payments directly to the co-operative society, state government, central government, or any housing agency under any housing scheme, or any promoter or builder, in one or more instalments, as the case maybe.

How much lump sum can be withdrawnThe maximum amount that can be withdrawn is up to 90 percent of the balance in the PF account or the cost of acquisition of the property, whichever is less. The balance will include members own share of contribution plus interest and employer's share of contribution plus interest. In the case of construction of the house and if it happens at a lower cost or the member doesn't get an allotment of the house ( where it was applied for), the amount has to be refunded back to EPFO within 30 days.

Making EMI payment through PFThe new rules allow a PF member who is also a member of any housing society, to dip into the PF to pay full or part EMI for a loan in member's name, after furnishing the details in a prescribed format. Sharma says, "Apart from the non-refundable loan, additionally there is now an option to repay the pending instalments to society on a monthly basis from the future PF contribution of the member which was not available in the past." EMI will then be paid by EPFO to the government, housing agency or the bank, as the case maybe.

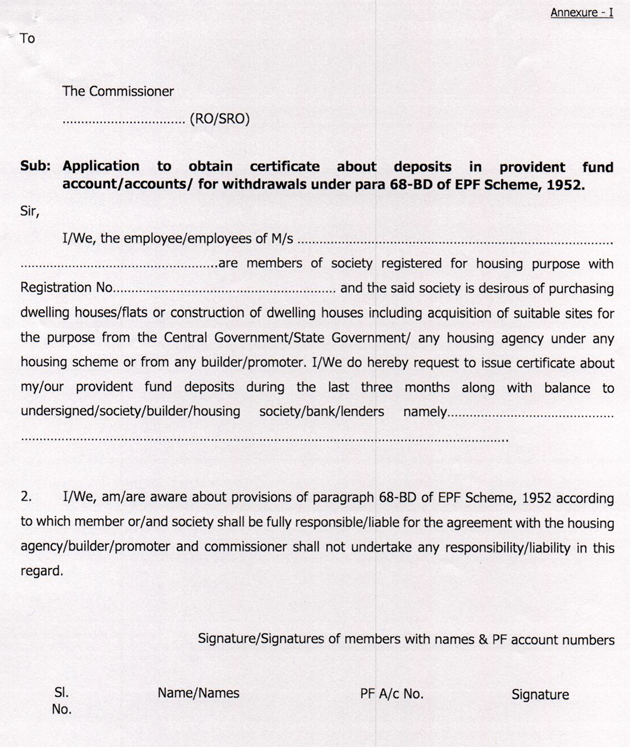

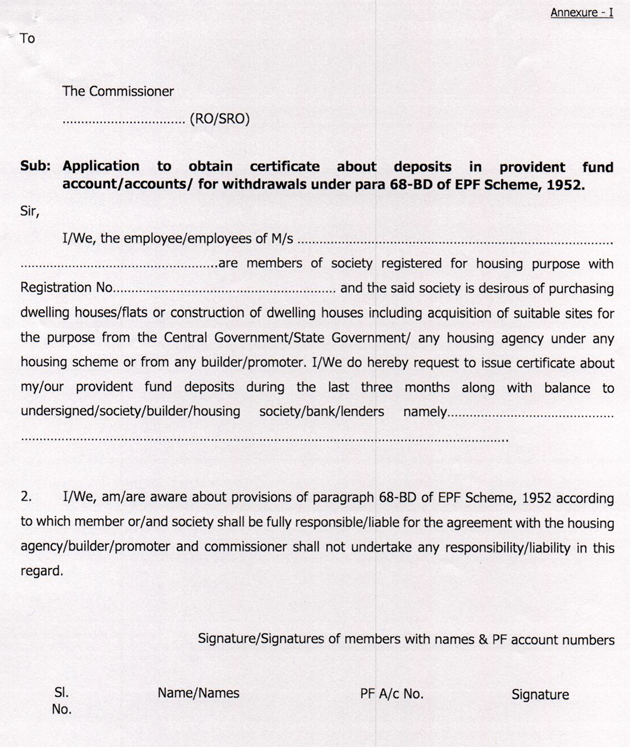

How to applyOnce a PF member has become a member of a housing society, he or she can apply individually or jointly through housing society in a prescribed format (Annexure-I) to get a certificate from the EPFO.

Annexure I

In the Annexure I form, the employees ask for the balance and the deposits made in the last three months before applying. This will help EPFO to determine how much EMI can be arrived at. Also, the employee has to mention the name and details of the bank or housing society to whom such certificate is to be issued.

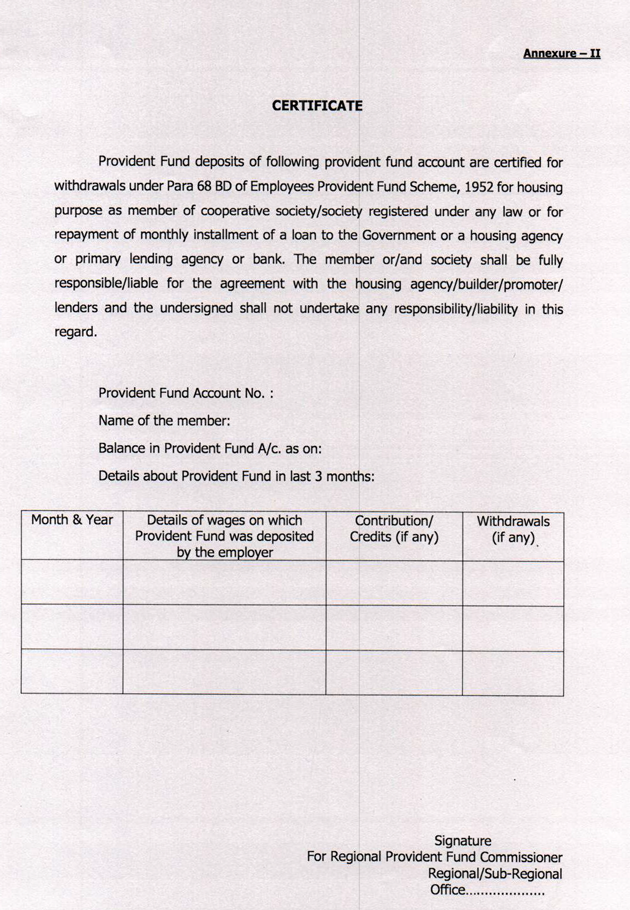

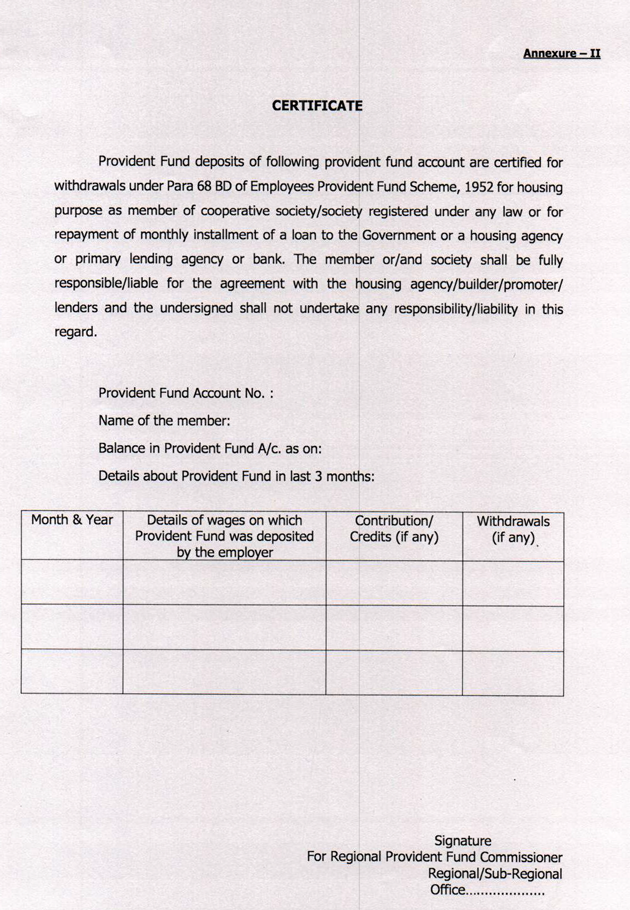

The EPFO then issues a certificate in a prescribed format (Annexure-II) showing the outstanding balance and last three month's deposit in the account.

Annexure II

Alternatively, members can take printouts of passbook downloaded from EPFO website and submit to housing agencies or banks.

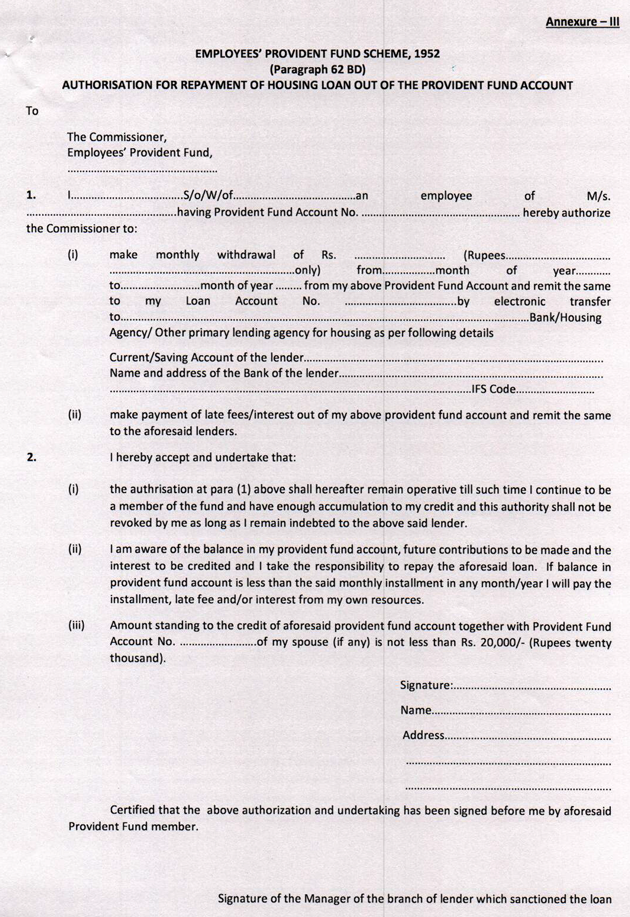

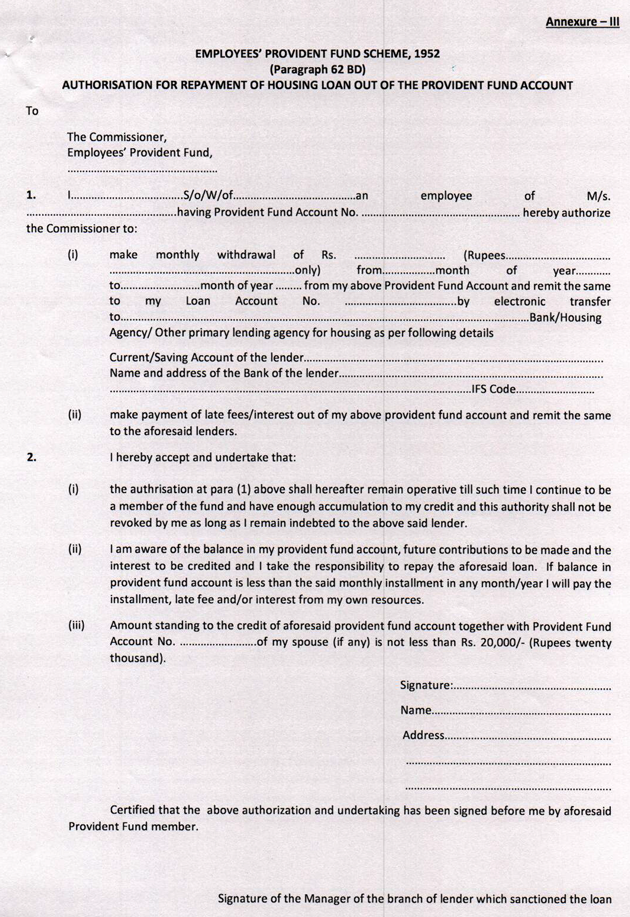

If a member wishes to use PF money to meet EMI's, then in addition to Annexure I, an authorisation by the member is to be filled in a prescribed format. (Annexure III).

Annexure III

It will carry details such as PF amount, PF and loan account number, lender name, address etc. One has to get this form authorised from the lender i.e. branch manager of the lender who has sanctioned the loan. Once approved, EPFO will start transferring EMI's online to the lender's account.

What if employee leaves the jobThe EPFO has made it clear that under no circumstances will it be liable for any default of payments to the lender. EPFO will not stand party to any agreement between member and society or builder. If an employee leaves service, it will be the responsibility of the member to repay the loan. In case the PF funds get over, the employee will have to arrange funds from own sources to meet the future EMIs.

One can avail this new PF withdrawal scheme along with the benefit under the PMAY.

Existing rules for house purchaseAs per the existing rules, for the purpose of purchase of a house from a promoter (Builder), membership period required is minimum 5 Years. The maximum that one may withdraw from the PF account is 36 month's basic wages or the total of employee and employer share with interest or total cost, whichever is least. One, however, need not be a member of a housing scheme to avail it.

ConclusionRemember, EPF is meant to take care of your post-retirement needs. Depleting it may jeopardise your retirement. Therefore, utmost caution should be applied before dipping into it. For those looking for a down payment amount may still consider it. Also, those who have a backup plan to meet post-retirement needs through equity mutual funds or PPF may still consider this route of owning a home. After all, it's one own money and what's good if it doesn't help me get a roof over one's head.

By: Ravi Kumar Diwaker (Magicbricks Bureau)

By: Ravi Kumar Diwaker (Magicbricks Bureau) NEW DELHI: The Narendra Modi government has pumped in three and half times more investments than the previous UPA government to improve basic urban

NEW DELHI: The Narendra Modi government has pumped in three and half times more investments than the previous UPA government to improve basic urban  By: Shaveta Dua, Magicbricks Bureau

By: Shaveta Dua, Magicbricks Bureau

The government it seems is pulling out all the stops in making 'Housing for All by 2022' a success. The initiative gets a shot in the arm by allowing members of

The government it seems is pulling out all the stops in making 'Housing for All by 2022' a success. The initiative gets a shot in the arm by allowing members of

By:

By: